8 3 Reteaching Trigonometric Ratios Continued Answers

Joshua earned an MBA from USF and writes mostly about software and technology.

The current ratio is an important measurement to help one understand how capable a company is at paying off current liabilities with current assets that can be found on the company balance sheet.

The current ratio calculation is very straightforward and commonly used to analyze the health of a company by potential investors, financial analysts, or stakeholders of a particular company. If a company needs a bank loan in one year, a stakeholder like a controller may want to put the company in a better position so that more credit can be obtained. This could be a reason to make company improvements that would make this ratio more appealing.

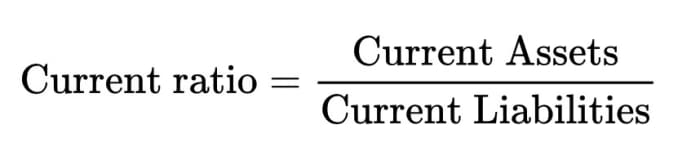

Current ratio equation

How to Calculate the Current Ratio

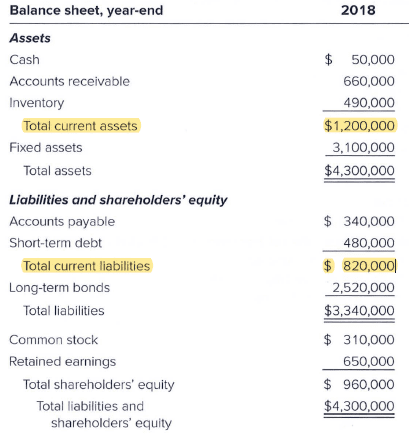

To find the current ratio, you must divide the dollar value of a company's current assets by the dollar value of its current liabilities. Both numbers can be found on a company's reported balance sheet like the one found in the illustration below.

To calculate the current ratio, you must divide the current liabilities but current assets. Both of these items can be located on the balance sheet. These items are highlighted in the example balance sheet above.

Created by Joshua Crowder

Example

For a current ratio example, look at the above balance sheet and figure out the current ratio. The current ratio for this company would be calculated as:

$1,200,000/$820,000 = 1.46

The result in this example tells us if current assets were liquidated, they would pay for almost one in a half times the current liability.

Scroll to Continue

Read More From Toughnickel

How to Interpret Current Ratio Results

An ideal current ratio would be 1.5 to 2. The result depends on what the industry standard happens to be. In the example, 1.46 tells us that we have enough current assets to cover our short-term current liabilities. If the industry for the given organization were, say, 1.3, one could claim that the organization is on target with this metric.

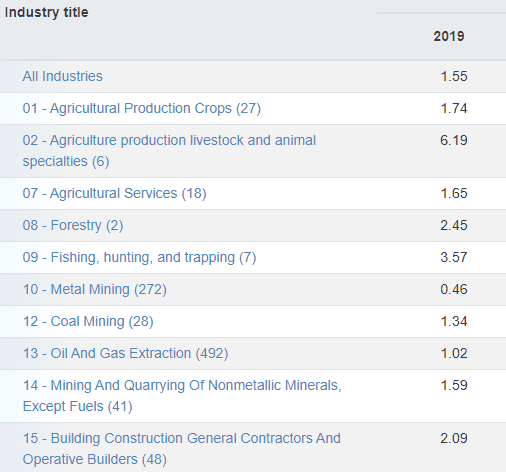

An example of current ratio standards for certain industries in 2019 can be found in the illustration below.

These industry standards ratio changes from year to year because it is composed from an average of over 4,000 companies.

Created by Joshua Crowder

How to Improve the Current Ratio

If the current ratio is over 2, it's not necessarily bad. It does mean that the most liquid assets will cover short-term debt and more. A current ratio that is too big may not make the company look good to investors.

In the event that the current ratio is at 5 or above, a company is may not be operating efficiently with regards to current assets. Conversely, when the current ratio is too low, it's obvious that a company would not be able to cover current liabilities if it ever became necessary to liquidate those assets to pay off current liabilities.

There are a number of ways that the current ratio can be improved to keep potential investors interested and current investors happy. These remedies can be seen below and should be used as suggestions. Keep in mind that all businesses are different and that adjustments may be different, depending on the business' structure and/or industry.

Sell Unproductive Assets

Assets that are not generating a return can be sold. The funds from these sales can be used to pay off the current debt to give the current ratio a boost. The ratio would become smaller in this situation because long-term assets would be sold to cover the short-term debt.

Delay Capital Expenditures

Delaying capital expenditures will help keep the cash account from running low until the company is in a better financial position.

Look for Term Loans That Can Be Re-Amortized

Reducing these monthly payments can help to increase cash on hand.

This content is accurate and true to the best of the author's knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2021 Joshua Crowder

Source: https://toughnickel.com/business/What-is-the-Current-Ratio

0 Response to "8 3 Reteaching Trigonometric Ratios Continued Answers"

Post a Comment