Long Term Goal for Feeding Therapy Autism

Long-term goals aren't easy to achieve. But why?

Could it be that motivation wanes over time? Perhaps external circumstances change. Maybe it has to do with the feasibility of the goals.

Many people have trouble sticking to something over the course of a single year let alone several years or decades.

Perhaps that's why long-term goals – like most financial goals – are so difficult to achieve.

How do we fight against whatever it is that holds us back from achieving these financial goals? Is it possible to win?

Yes. It is.

Today I'd like to share with you some ways you can achieve your long-term financial goals. I won't claim it will be easy, but it will be worthwhile.

So whether you need to pay off debt, build an emergency fund, save for your kids' college education, or invest for retirement, here are some ways you can make it hap'n, cap'n.

1. Capture your long-term goals in your to-do list.

Long-term goals of the financial sort are usually more like projects than individual tasks.

For example, if you want to pay off your debt, chances are that you don't just have one credit card to pay off – you might have three credit cards, a vehicle loan, and a student loan to overcome (if not more).

"Pay off debt" would be the project. "Pay off Visa #1" would be the task.

The truth is that without writing down your projects and tasks within a task management system of some type, you're much less likely to accomplish your long-term goals.

There's just something about seeing your long-term goals on paper (or on a screen) that makes them real. The very act of writing them down is a type of commitment.

Give it a whirl. Write down your long-term financial goals and review them on a regular basis.

2. Don't bury your long-term goals.

It's not enough to write down your long-term financial goals. Additionally, you need to make them readily available to your eye.

One idea that I've found works well is to write down your goals on a whiteboard where you can't help but see them. But that's not for everybody.

The point is that you need to find a way to see your long-term goals in the context of all your other goals (namely, your short-term goals). If only your short-term, urgent goals are displayed for you to see, you'll tend to focus on those instead of kicking butt on your long-term goals.

Don't bury your long-term goals. They're important too!

3. Dedicate certain days of the week to long-term goals.

One helpful tip I derived from Strategic Coach was to dedicate certain days of the week to certain goals. This has proved to be very helpful in my own life, and I believe it will in yours, too.

For example, you could dedicate a certain day of the week to managing your finances and brainstorming ways to improve your financial future. Perhaps you have a day off of work that would work best for you.

Now, I can hear you saying, "Oh Jeff, if I only had a day for such tasks – I'm way too busy with other stuff!" That's fair.

But here's the thing, you don't just have to make this day about finances – you can make it about your other long-term goals too. Add in health, family, and other areas of responsibility. Consider this day (or these days) of the week to be all about bettering yourself and your life. Can't you make time for that?

4. Prioritize your long-term goals properly.

When it comes to long-term financial goals, you need to properly prioritize them. There are some preliminary goals that should only take you less than a month, like setting up a budget and cutting expenses, but we'll leave that for another article.

What are some common long-term financial goals and in which order should you complete them? Generally, I recommend you complete the following long-term financial goals in the order they are displayed below:

Build Your Emergency Fund

Think of your emergency fund as the foundation of your financial future. Without some liquid money, you're going to be out of luck when financial disaster strikes. Believe me, they happen.

Your car engine might explode. Your kneecap might explode (ouch). Your water heater might explode. There are so many things that can explode . . . and it's not easy to just walk away from those explosions while keeping your cool. It's stressful!

But you know what would make those situations a little less stressful? You guessed it:an emergency fund baby!

Wipe Out Your Debt

Once you have your foundation in place, it's time to knock out that debt. This can take several years or a few months – it depends on how much debt you have and how quickly you can shovel money at it.

Write down all of your debts and attack them one by one. It's easier that way.

Start Investing for Retirement

Now it's time to start investing for your latter years. Why? It's possible that your earning potential can go down when you're physically unable to work. Who knows, you might have a self-sustaining business upon reaching retirement age, but don't count on it. Invest for the future!

Helping people retire well is what I do.

Start Saving for Other Long-Term Goals

This might include saving for your kids' college education, purchasing a new vehicle, saving for a home renovation, or another goal that will take some time.

By prioritizing your long-term goals in the proper way, you can ensure that should you experience a slump in income, you aren't wiped out due to a lack of financial planning.

5. Discover and focus on your motivations.

I'm convinced that one of the main reasons people don't accomplish their long-term goals is because they really haven't discovered their motivations.

For example, everyone knows it's a good idea to pay off debt. It's a financial goal that's been embedded in our minds by countless financial advisors. But unless you discover your motivation for paying off debt, chances are you'll give up before you achieve your goal.

In fact, if you're paying off debt for the sake of paying off debt, you might as well give up now. You're not going to be motivated enough to get the job done.

Instead, focus on some common motivations that can become your motivations. Here are some great reasons why people want to pay off debt:

- To not have to pay interest on their purchases

- To free up money for vacations

- To free up money for investing for retirement

- To not have to worry about those bills

- To reduce the amount of stress in their lives

- To free up the time it takes managing debt to focus on family

These are just a few of the motivations of others. What's your motivation?

Assign a motivation for every long-term goal you have. Otherwise, you're just trying to accomplish your long-term goals for the sake of accomplishing them – that's not a real motivating factor if you ask me!

Long-Term Goal Examples

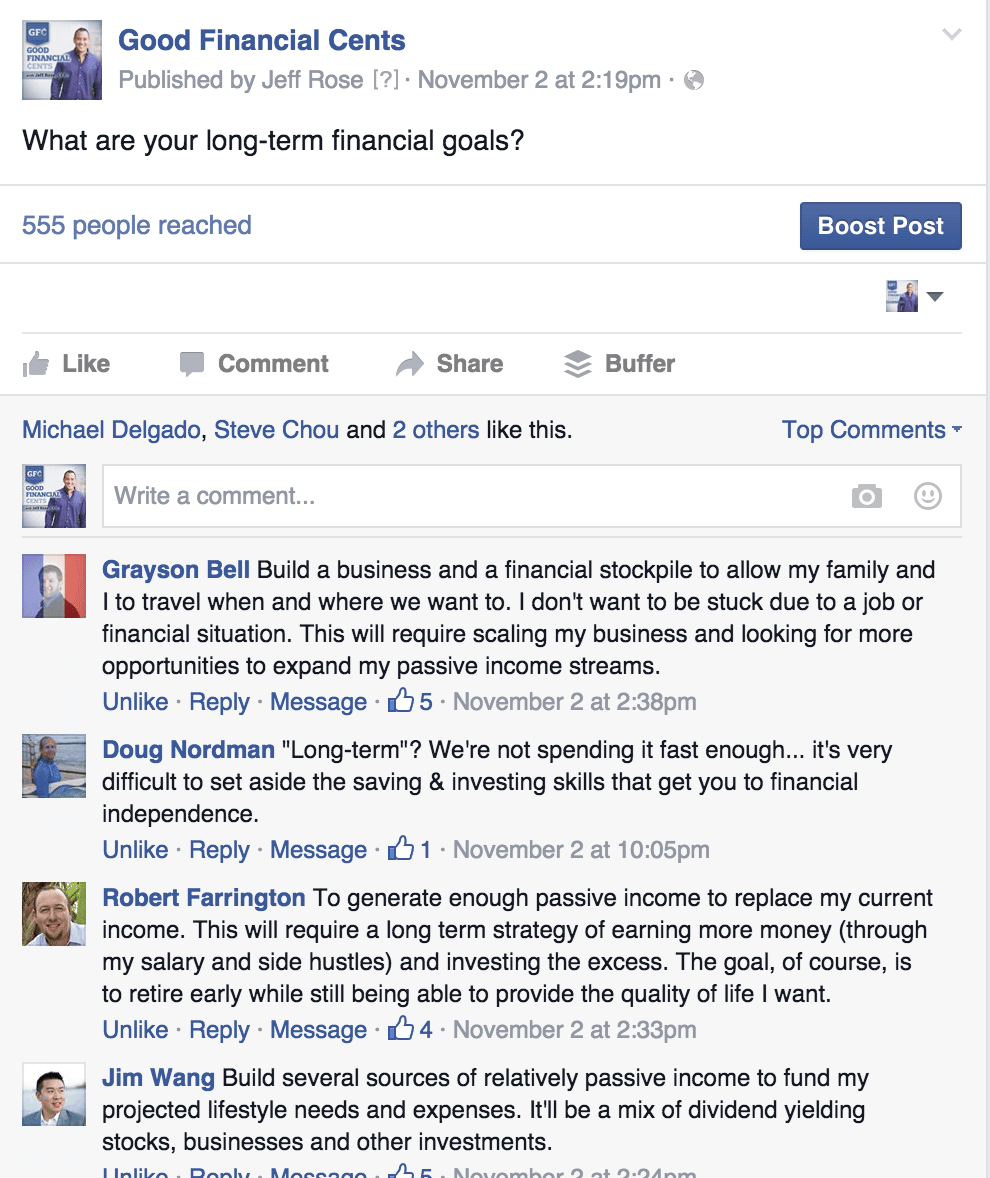

Knowing I'm not the only goal-setting freak that exists in this world, I asked fans from the Good Financial Cents Facebook page what their long-term goals (big shout to the Fincon community for contributing, too!).

Fincon Community Long-Term Goals

Here's a great list of examples of long-term goals:

Bob Lotich at SeedTime.com says:

[I want] to provide a comfortable life for my family, to have enough cash to maintain a flexible lifestyle, and to use everything else to financially support charities and organizations that are making a huge impact on the world.

Ryan Guina at TheMilitaryWallet.com says:

[I want] to become financially independent. What this means to me: to have no consumer or mortgage debt and have enough resources in savings and investments to cover my everyday living expenses without relying upon income from my job. This will provide more freedom in pursuing activities based on fulfillment vs. the need to generate revenue.

Larry Ludwig at InvestorJunkie.com says:

[I want] to be financially free. I define it specifically as to accumulate $10,000,000 in investment assets that can generate at minimum 4% per year of income.

Teresa Mears at LivingOnTheCheap.com says:

[I want] to support myself, both now and in retirement, and enjoy life. What else is there?

Steve Chou at MyWifeQuitHerJob.com says:

[I want] to generate enough income so that I can spend more time with my family and be there for the kids. Growing up, my parents worked their butts off so I could go to a good school but I didn't see them very often during the week. With my kids, I'm going to send them to a good college and always be present.

Grayson Bell at DebtRoundup.com says:

[I want to] build a business and a financial stockpile to allow my family and I to travel when and where we want to. I don't want to be stuck due to a job or financial situation. This will require scaling my business and looking for more opportunities to expand my passive income streams.

Robert Farrington at TheCollegeInvestor.com says:

[I want] to generate enough passive income to replace my current income. This will require a long-term strategy of earning more money (through my salary and side hustles) and investing the excess. The goal, of course, is to retire early while still being able to provide the quality of life I want.

My Lifetime Goals

Long-term goals can be difficult to articulate but deserve to be written down. I previously shared my lifetime goals on this post. Looking them over I recognize I would make a few tweaks, but; for the most part, they are still align with what I want to achieve in life. Here's a look:

1. Spiritual leader of my household. I want my kids to see me first as a God-loving father who puts his faith first before success. I want to continually love and support my wife, and do so in an Godly manner.

2. Live a long and filling life with my wife and family. Raise my kids with the philosophies of: working hard, but not sacrificing "work" for what you love; love first; and treat people with respect (Golden Rule)

3. Have several multiple-system driven businesses that produce >$100,000 a month of passive income.

4. Live in multiple countries (5+) for an extended period of time (minimum 3 weeks) with entire family

5. Inspire over 1,000,000 people to invest in themselves. This can be through traditional investing (Roth IRA, 401k), obtaining a higher degree or certification, or investing in a small business.

6. Be a successful entrepreneur and best-selling author of numerous works. I want to be recognized as as a hard worker who put his family and faith first.

Here's your homework

I want you to implement at least one of these strategies for reaching your long-term goals over the next year. When the year is over, write me. Tell me how well the strategy worked out for you. I want you to put your heart and soul into one or more of these strategies.

Why? I want you to see success.

Make it hap'n, cap'n!

Need some more long-term goals? Check out The Top 10 Good Financial Goals That Everyone Should Have. If you're a baby boomer, check out 5 Financial Goals for Baby Boomers.

Source: https://www.goodfinancialcents.com/long-term-goals-examples/

0 Response to "Long Term Goal for Feeding Therapy Autism"

Post a Comment