Again Consider the Long Run Model. This Is a Closed Economy With Net Exports X=0

The Mundell–Fleming model, likewise known equally the IS-LM-BoP model (or IS-LM-BP model), is an economic model first prepare along (independently) past Robert Mundell and Marcus Fleming.[1] [2] The model is an extension of the IS–LM model. Whereas the traditional IS-LM model deals with economy under autarky (or a closed economy), the Mundell–Fleming model describes a modest open economy.

The Mundell–Fleming model portrays the short-run relationship betwixt an economic system'due south nominal commutation rate, interest rate, and output (in contrast to the closed-economic system IS-LM model, which focuses merely on the human relationship between the involvement rate and output). The Mundell–Fleming model has been used to argue [3] that an economy cannot simultaneously maintain a stock-still substitution charge per unit, free majuscule movement, and an independent monetary policy. An economy can only maintain two of the three at the same time. This principle is frequently called the "incommunicable trinity," "unholy trinity," "irreconcilable trinity," "inconsistent trinity," "policy trilemma," or the "Mundell–Fleming trilemma."

Basic ready-up [edit]

Assumptions [edit]

Basic assumptions of the model are every bit follows:[i]

- Spot and forrad exchange rates are identical, and the existing exchange rates are expected to persist indefinitely.

- Stock-still coin wage rate, unemployed resource and constant returns to scale are assumed. Thus domestic price level is kept constant, and the supply of domestic output is elastic.

- Taxes and saving increment with income.

- The balance of trade depends only on income and the exchange rate.

- Majuscule mobility is less than perfect and all securities are perfect substitutes. Only risk neutral investors are in the organisation. The demand for coin therefore depends only on income and the interest rate, and investment depends on the interest rate.

- The country nether consideration is so minor that the country cannot affect foreign incomes or the world level of interest rates.

Variables [edit]

This model uses the post-obit variables:

- Y is real Gross domestic product

- C is existent consumption

- I is existent physical investment, including intended inventory investment

- G is real government spending (an exogenous variable)

- M is the exogenous nominal money supply

- P is the exogenous toll level

- i is the nominal interest rate

- L is liquidity preference (real coin demand)

- T is existent taxes levied

- NX is real net exports

Equations [edit]

The Mundell–Fleming model is based on the post-obit equations:

The IS curve:

where NX is cyberspace exports.

The LM curve:

A college interest rate or a lower income (Gross domestic product) level leads to lower money demand.

The BoP (Balance of Payments) Curve:

where BoP is the rest of payments surplus, CA is the current account surplus, and KA is the upper-case letter account surplus.

IS components [edit]

where E(π) is the expected charge per unit of inflation. Higher disposable income or a lower real interest rate (nominal interest rate minus expected inflation) leads to college consumption spending.

where Y t-1 is Gross domestic product in the previous period. Higher lagged income or a lower real interest rate leads to higher investment spending.

where NX is net exports, e is the nominal exchange rate (the price of foreign currency in terms of units of the domestic currency), Y is GDP, and Y* is the combined Gdp of countries that are foreign trading partners. Higher domestic income (GDP) leads to more spending on imports and hence lower net exports; college foreign income leads to college spending past foreigners on the country'southward exports and thus higher internet exports. A higher e leads to higher net exports.

Balance of payments (BoP) components [edit]

where CA is the current account and NX is cyberspace exports. That is, the current account is viewed as consisting solely of imports and exports.

where is the strange interest rate, k is the exogenous component of fiscal capital flows, z is the involvement-sensitive component of capital flows, and the derivative of the function z is the degree of majuscule mobility (the effect of differences between domestic and foreign involvement rates upon capital flows KA).

Variables determined by the model [edit]

After the subsequent equations are substituted into the first three equations above, ane has a system of 3 equations in three unknowns, two of which are Gross domestic product and the domestic interest charge per unit. Nether flexible substitution rates, the exchange rate is the third endogenous variable while BoP is set equal to cipher. In contrast, nether fixed substitution rates e is exogenous and the residual of payments surplus is determined by the model.

Under both types of exchange charge per unit regime, the nominal domestic money supply M is exogenous, but for different reasons. Under flexible substitution rates, the nominal money supply is completely under the command of the cardinal bank. But under fixed commutation rates, the money supply in the short run (at a given point in time) is fixed based on past international money flows, while every bit the economy evolves over time these international flows crusade future points in fourth dimension to inherit higher or lower (but pre-determined) values of the coin supply.

Mechanics of the model [edit]

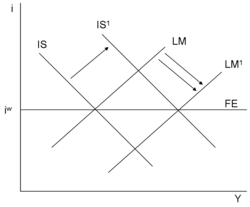

The model'due south workings can be described in terms of an IS-LM-BoP graph with the domestic interest charge per unit plotted vertically and real Gdp plotted horizontally. The IS bend is down sloped and the LM curve is up sloped, every bit in the closed economy IS-LM analysis; the BoP bend is upward sloped unless at that place is perfect majuscule mobility, in which case it is horizontal at the level of the world interest rate.

In this graph, under less than perfect capital mobility the positions of both the IS curve and the BoP curve depend on the exchange rate (as discussed below), since the IS-LM graph is actually a 2-dimensional cross-section of a three-dimensional space involving all of the interest charge per unit, income, and the exchange rate. However, nether perfect capital mobility the BoP curve is simply horizontal at a level of the domestic interest rate equal to the level of the earth interest rate.

Summary of dominance of budgetary and fiscal policy [edit]

As explained beneath, whether domestic monetary or fiscal policy is potent, in the sense of having an event on real Gdp, depends on the exchange rate regime. The results are summarized here.

Flexible exchange rates: Domestic monetary policy affects Gdp, while financial policy does not.

Fixed exchange rates: Fiscal policy affects Gross domestic product, while domestic budgetary policy does non.

Flexible commutation charge per unit regime [edit]

In a organization of flexible exchange rates, central banks let the exchange charge per unit to be determined past market forces alone.

Changes in the money supply [edit]

An increase in coin supply shifts the LM bend to the right. This directly reduces the local interest rate relative to the global involvement rate. That being said, capital outflows will increment which volition lead to a decrease in the existent exchange charge per unit, ultimately shifting the IS curve correct until interest rates equal global involvement rates (assuming horizontal BOP). A decrease in the money supply causes the exact opposite procedure.

Changes in government spending [edit]

An increment in government expenditure shifts the IS bend to the right. This will mean that domestic interest rates and Gdp rise. Withal, this increment in the interest rates attracts strange investors wishing to have advantage of the higher rates, then they need the domestic currency, and therefore it appreciates. The strengthening of the currency will hateful it is more expensive for customers of domestic producers to purchase the home country's exports, then net exports volition decrease, thereby cancelling out the rise in government spending and shifting the IS bend to the left. Therefore, the rise in authorities spending volition have no effect on the national GDP or interest rate.

Changes in the global involvement charge per unit [edit]

An increase in the global interest rate shifts the BoP curve upward and causes capital flows out of the local economy. This depreciates the local currency and boosts net exports, shifting the IS curve to the right. Under less than perfect majuscule mobility, the depreciated exchange rate shifts the BoP curve somewhat back down. Under perfect capital mobility, the BoP curve is always horizontal at the level of the earth interest rate. When the latter goes up, the BoP curve shifts upward by the same amount, and stays there. The commutation charge per unit changes enough to shift the IS curve to the location where it crosses the new BoP curve at its intersection with the unchanged LM curve; now the domestic interest rate equals the new level of the global involvement rate.

A decrease in the global involvement charge per unit causes the reverse to occur.

Fixed commutation charge per unit government [edit]

In a organization of fixed exchange rates, fundamental banks announce an exchange rate (the parity rate) at which they are prepared to buy or sell any amount of domestic currency. Thus net payments flows into or out of the country need not equal zero; the commutation rate eastward is exogenously given, while the variable BoP is endogenous.

Under the fixed exchange rate system, the central bank operates in the foreign exchange market to maintain a specific exchange rate. If there is pressure to devalue the domestic currency's exchange rate considering the supply of domestic currency exceeds its demand in foreign exchange markets, the local authorization buys domestic currency with strange currency to decrease the domestic currency'due south supply in the foreign exchange market place. This keeps the domestic currency's exchange rate at its targeted level. If there is pressure to appreciate the domestic currency'south exchange rate considering the currency'due south need exceeds its supply in the foreign exchange marketplace, the local authorization buys foreign currency with domestic currency to increase the domestic currency's supply in the foreign commutation marketplace. Again, this keeps the exchange rate at its targeted level.

Changes in the coin supply [edit]

In the very short run the money supply is normally predetermined by the by history of international payments flows. If the central bank is maintaining an exchange rate that is consequent with a balance of payments surplus, over time money will period into the land and the money supply volition rise (and vice versa for a payments deficit). If the key bank were to comport open marketplace operations in the domestic bail marketplace in order to showtime these residual-of-payments-induced changes in the coin supply — a process chosen sterilization – it would blot newly arrived money by decreasing its holdings of domestic bonds (or the opposite if money were flowing out of the country). But under perfect capital mobility, any such sterilization would be met by further offsetting international flows.

Changes in regime expenditure [edit]

An increase in government spending forces the budgetary authority to supply the market with local currency to keep the exchange rate unchanged. Shown here is the case of perfect capital mobility, in which the BoP curve (or, equally denoted here, the Fe curve) is horizontal.

Increased government expenditure shifts the IS curve to the right. The shift results in an incipient rise in the involvement rate, and hence upward pressure on the substitution rate (value of the domestic currency) as foreign funds start to catamenia in, attracted by the higher interest rate. Yet, the exchange rate is controlled by the local budgetary say-so in the framework of a fixed commutation charge per unit system. To maintain the exchange rate and eliminate pressure on it, the monetary potency purchases foreign currency using domestic funds in order to shift the LM bend to the right. In the stop, the involvement rate stays the same simply the general income in the economy increases. In the IS-LM-BoP graph, the IS curve has been shifted exogenously past the fiscal authority, and the IS and BoP curves determine the final resting place of the system; the LM curve simply passively reacts.

The reverse procedure applies when government expenditure decreases.

Changes in the global involvement rate [edit]

To maintain the fixed exchange rate, the central bank must accommodate the capital flows (in or out) which are caused by a modify of the global interest charge per unit, in guild to offset pressure on the exchange rate.

If the global involvement rate increases, shifting the BoP bend upward, capital flows out to take advantage of the opportunity. This puts pressure on the habitation currency to depreciate, so the central banking concern must buy the dwelling currency — that is, sell some of its foreign currency reserves — to suit this outflow. The subtract in the coin supply, resulting from the outflow, shifts the LM bend to the left until it intersects the IS and BoP curves at their intersection. Over again, the LM curve plays a passive role, and the outcomes are determined past the IS-BoP interaction.

Under perfect capital mobility, the new BoP curve will be horizontal at the new world interest rate, and so the equilibrium domestic interest rate will equal the globe involvement rate.

If the global involvement rate declines beneath the domestic rate, the contrary occurs. The BoP curve shifts down, foreign money flows in and the abode currency is pressured to appreciate, so the fundamental banking company offsets the pressure level by selling domestic currency (equivalently, ownership foreign currency). The inflow of money causes the LM curve to shift to the right, and the domestic interest rate becomes lower (as depression equally the world interest rate if there is perfect upper-case letter mobility).

Differences from IS-LM [edit]

Some of the results from this model differ from those of the IS-LM model because of the open economy supposition. Results for a large open up economy, on the other hand, tin be consistent with those predicted by the IS-LM model. The reason is that a large open economy has the characteristics of both an autarky and a small open economic system. In particular, it may not face up perfect capital mobility, thus assuasive internal policy measures to touch the domestic involvement rate, and it may be able to sterilize rest-of-payments-induced changes in the money supply (every bit discussed in a higher place).

In the IS-LM model, the domestic interest rate is a key component in keeping both the money market and the goods market in equilibrium. Under the Mundell–Fleming framework of a small economy facing perfect capital mobility, the domestic involvement rate is fixed and equilibrium in both markets can merely be maintained by adjustments of the nominal substitution rate or the money supply (by international funds flows).

Example [edit]

The Mundell–Fleming model practical to a small open up economy facing perfect capital mobility, in which the domestic involvement charge per unit is exogenously adamant by the world involvement rate, shows stark differences from the closed economy model.

Consider an exogenous increase in government expenditure. Under the IS-LM model, the IS curve shifts rightward, with the LM bend intact, causing the interest rate and output to rise. Simply for a small open up economy with perfect capital letter mobility and a flexible exchange charge per unit, the domestic involvement rate is predetermined by the horizontal BoP curve, and and so by the LM equation given previously there is exactly i level of output that tin make the money market be in equilibrium at that interest rate. Any exogenous changes affecting the IS bend (such as government spending changes) volition exist exactly beginning by resulting exchange rate changes, and the IS curve volition stop upwardly in its original position, still intersecting the LM and BoP curves at their intersection betoken.

The Mundell–Fleming model under a stock-still exchange charge per unit regime also has completely different implications from those of the airtight economy IS-LM model. In the closed economy model, if the central bank expands the money supply the LM curve shifts out, and as a issue income goes up and the domestic interest charge per unit goes down. But in the Mundell–Fleming open up economy model with perfect capital mobility, budgetary policy becomes ineffective. An expansionary monetary policy resulting in an incipient outward shift of the LM curve would make uppercase flow out of the economic system. The cardinal bank under a stock-still exchange rate system would have to instantaneously intervene by selling foreign money in exchange for domestic money to maintain the commutation rate. The accommodated monetary outflows exactly commencement the intended rise in the domestic money supply, completely offsetting the tendency of the LM bend to shift to the right, and the interest charge per unit remains equal to the world rate of interest.

Criticism [edit]

Exchange rate expectations [edit]

One of the assumptions of the Mundell–Fleming model is that domestic and foreign securities are perfect substitutes. Provided the world interest rate is given, the model predicts the domestic charge per unit will become the same level of the globe rate by arbitrage in money markets. Notwithstanding, in reality, the world interest rate is dissimilar from the domestic rate. Rüdiger Dornbusch considered how exchange rate expectations have an effect on the exchange rate.[4] Given the approximate formula:

and if the elasticity of expectations , is less than unity, and so we accept

Since domestic output is , the differentiation of income with regard to the exchange rate becomes

The standard IS-LM theory gives the states the following bones relations:

Investment and consumption increase as the interest rates decrease, and currency depreciation improves the trade residual.

And then the total differentiations of trade residue and the demand for coin are derived.

and and then, information technology turns out that

The denominator is positive, and the numerator is positive or negative. Thus, a budgetary expansion, in the short run, does not necessarily improve the trade balance. This result is non compatible with what the Mundell-Fleming predicts.[4] This is a result of introducing commutation rate expectations which the MF theory ignores. Nevertheless, Dornbusch concludes that monetary policy is withal effective even if it worsens a merchandise balance, because a budgetary expansion pushes downwardly interest rates and encourages spending. He adds that, in the brusque run, fiscal policy works because information technology raises interest rates and the velocity of money.[4]

See also [edit]

- Optimum currency surface area

- Marshall–Lerner condition

References [edit]

- ^ a b Mundell, Robert A. (1963). "Capital mobility and stabilization policy nether stock-still and flexible exchange rates". Canadian Journal of Economics and Political Scientific discipline. 29 (4): 475–485. doi:10.2307/139336. JSTOR 139336. Reprinted in Mundell, Robert A. (1968). International Economics. New York: Macmillan.

- ^ Fleming, J. Marcus (1962). "Domestic financial policies under stock-still and floating exchange rates". Imf Staff Papers. ix: 369–379. doi:10.2307/3866091. JSTOR 3866091. Reprinted in Cooper, Richard Northward., ed. (1969). International Finance. New York: Penguin Books.

- ^ Obstfeld, Robert (2005). "The Trilemma in History: Tradeoffs among Exchange Rates, Monetary Policies, and capital mobility". The Review of Economics and Statistics. Vol. 87. pp. 423–438. JSTOR 40042939.

- ^ a b c Dornbusch, R. (1976). "Commutation Rate Expectations and Budgetary Policy". Periodical of International Economics. 6 (3): 231–244. doi:10.1016/0022-1996(76)90001-five.

Further reading [edit]

- Young, Warren; Darity, William, Jr. (2004), "IS-LM-BP: An Inquest" (PDF), History of Political Economy, 36 (Suppl 1): 127–164, doi:x.1215/00182702-36-Suppl_1-127, S2CID 155035113, archived from the original (PDF) on 2009-02-19 (Tells the difference betwixt the IS-LM-BP model and the Mundell–Fleming model.)

- Carlin, Wendy; Soskice, David W. (1990), Macroeconomics and the Wage Bargain, New York: Oxford University Press, ISBN0-nineteen-877245-9

- Mankiw, Northward. Gregory (2007), Macroeconomics (6th ed.), New York: Worth, ISBN978-0-7167-6213-3

- Blanchard, Olivier (2006), Macroeconomics (fourth ed.), Upper Saddle River, NJ: Prentice Hall, ISBN0-13-186026-7

- DeGrauwe, Paul (2000), Economics of Monetary Marriage (4th ed.), New York: Oxford University Press, ISBN0-19-877632-2

Source: https://en.wikipedia.org/wiki/Mundell%E2%80%93Fleming_model

0 Response to "Again Consider the Long Run Model. This Is a Closed Economy With Net Exports X=0"

Post a Comment